2013-09-16 - 5879.400 - Spec - Direct ship from Derby to Canadian customers #Billing #US

SPECIFICATIONS

5879 - Direct ship from Derby to Canadian customers

Purpose

Update pricing procedure and EDI mapping for ICO US-Canada

Admin Info

| Purpose |

Update pricing procedure and EDI mapping |

| Requested By |

Joan Profetta |

| Spec Created By |

Surya Basa |

| Spec Created Date |

09/16/2013 |

| Spec QA by |

Surya Basa |

| Objects |

V_T683 VEDI_LOGV3 MV45AFZZ |

| Document Status |

Complete |

References

Prior Tickets

NoneDocuments

NoneFunctional Requirement

Enable direct shipment from Derby to Canadian customers in SAP and Chainlink.

Solution Summary

[Discuss this section with Requester and get approval prior to beginning work]

1. The solution involves updating the pricing procedure ZNECCA for Canada and EDI mapping for ICO IDOC posting in company code 0020.

2. Customize the order entry to default, "CA" (Canada) as the country in the Tax Departure Country field at header to trigger Canadian taxes.

Test Plan

[List test scenarios/cases to be executed here]| Test Scenario |

Expected Results |

| Test ICO scenario for US-CA as below- 1. Create sales order for Canada customer in sales area 1200/10/00 with plant 0110. 2. ARUN and create delivery followed by F2 and IV invoice. Pre-requisites- 1. Maintain condition record for IV02 (PI02) as 120% 2. Maintain condition record for RD04 output for sales org and billing type. |

1. The sales document followed by delivery, F2 and IV documents should be created successfully. 2. F2 pricing should be correct (PI02 condition should be calculated on cost), accounting and COPA documents should be posted correctly. 3. IV document should be created with correct accounting and COPA postings. IV02 Inter company price should be calculated as 120% of cost. 4. RD04 output should trigger the IDOC and post stock value and revenue in company code 0020. |

| Test Tax Departure Country default to CA Create sales order for Canada customer in sales area 1200/10/00 with plant 0110 |

The Tax Departure Country field at the sales order header in Billing Document tab should default to CA and Canadian taxes should trigger in the pricing conditions. |

Solution Details

[Provide complete technical details for configuration or programming here]

1. Pricing procedure ZNECCA was updated with condition type ZPRS at step 58.

2. Pricing procedure ZNEINT was updated with ZPRS condition at step 12 and IV02 condition was calculated on step 12.

3. Pricing procedure determination was updated with conditoin type IV02 for the combination of- Sales Area - Doc Pric Proc - Cust Pric Proc - Cond Typ

1000/10/00 - I - 1 - ZNEINT - IV02

1000/10/10 - I - 1 - ZNEINT - IV02

1000/10/20 - I - 1 - ZNEINT - IV02

4. PI02 condition set to calculate on ZPRS value.

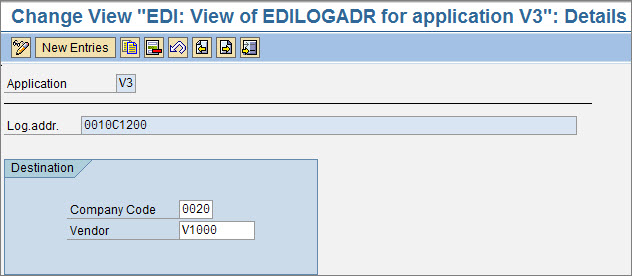

5. EDI mapping was set up in WEL1 transaction ICO bill to party (C1200) and vendor (V1000) for posting the ICO IDOC in company 0020 (NEC Canada) for the combination of - 0010C1200 and 0020V1000

6. In user exit MV45AFZZ, we have hard coded country field as CA when sales org = 1200 and plant = 0110.

Issues

None